Mercatox – Crypto broker review

Mercatox is a decent-sized worldwide crypto broker. It’s unknown where the company comes from and where the servers are, since they don’t disclose this type of information, nor is there any sort of documentation to let you know what you’re dealing with. If you are a personality who only deals with documented and monitored services, you can jump off this train right now. For everyone else, let’s examine this exchange.

It doesn’t have too many features in any field, as you may notice further down the article. However, if the present options are something worth staying for, then the broker isn’t necessarily a bad one. Regardless, because of the secretive nature of the platform, only a thorough investigation of the reviews left by Mercatox users can tell if that’s the case.

But before we jump into this realm, let’s examine Mercatox a bit close and see what it has to offer.

What is Mercatox?

In terms of trading capabilities, Mercatox reportedly has several hundred trading pair. If you visit their ‘trade’ page and scroll through the lists, you’ll see that the platform does have several hundred trading crypto pairs, but there are several problems with them:

- The overwhelming majority of the coins and tokens are near worthless and aren’t very liquid on average

- You can’t ‘trade’ here, per se. You can only exchange your coins. A lot of the coins that you buy here can not in turn be sold, for instance

It’s a bit confusing to call what’s essentially a pure exchange a ‘trading market’. You can deposit crypto into Mercatox, but you can’t speculate on prices indefinitely. You can conclude one deal and then you’ll have to withdraw your winnings. There is one liquid two-way ETH/BTC pair, but it’s not even featured on the general list, so it’s even more confusing.

Additionally, you can buy on margin and borrow funds from a broker. The difference is pretty small. In one case you’ll use the money to fund your orders, and in another you just borrow currency without specifications. The difference is barely there, which is interesting.

That’s pretty much it for the technical capabilities. As for the surrounding content, there’s no educational material like on other exchange, and, interestingly, you can only find 3 languages to work with:

- Russian

- English

- Chinese

Not a lot to work with, but if Mercatox worked hard on what they did implement, it may be worth checking out, as mentioned above.

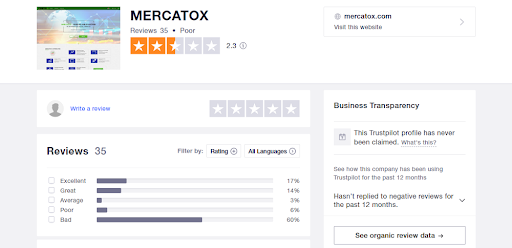

The rating

Unfortunately, the Mercatox user reviews are fairly scarce. There are only a few dozen of them on the popular aggregators. The average rating on trustpilot.com sits at around 2.3/5 as of October 2020. It’s a very poor result, and it’ll be interesting to see what Mercatox did wrong exactly, according to the feedback on Trustpilot.

The disadvantages

Let’s first go through all the flaws you can find on broker’s side, and then move on to the few benefits they have.

- Poor support

There are several general topics of complaint about the broker. First, it takes a very long time for them to fix your issues, and sometimes they are simply unable to do so, all the while assuring you that the problem is going to be fixed soon. Second, not all support agents speak English on a good-enough level, so you can experience even more delay thanks to that.

- Withdrawal mechanisms are terrible

Withdrawing issues are common amongst the exchanges and other brokers, Mercatox is no exception. This issue is also fairly complex and consists of several lesser nuisances. The most frequent two are delays and unavailability. Delays are a product of constant maintenance, and you can expect the process to take from 1 day to several weeks of your time.

The unavailability is a bit less frequent, but it’s still surprising that sometimes you can’t withdraw your funds simply because there’s no option for the specific currency. It could be understandable if it was the case for smaller coins, and not LTC, for instance.

- Constant interventions

The company doesn’t intervene in market processes, as a rule. However, the financial policy (including fees, withdrawals and deposits) can change its rules daily without you knowing it. Withdraw fees are especially shifty. Because of the constant silent revisions you may found that withdrawing your funds from the platform suddenly costs a lot more than you expected.

In some cases, they can basically restrict withdrawing of some currencies to some minimal amount, and that means they’ll be stuck there forever.

The advantages

There’s very little to commend the platform for. It has some good aspects, but they are just basic necessities that every self-respecting broker should have.

- Good interface

The platform has a fairly good market interface that enables people to buy and sell very quickly and with minimal issues. It can’t be underappreciated, because you can wait for the delayed withdrawing to finally happen, but you can’t wait for the purchase to happen if it needs to happen in the fraction of a second.

Mercatox allows it, yet great performance is probably not enough to justify everything else.

Conclusion

You shouldn’t go for an overall poor exchange just because it has some redeeming features. If you want to trade on Mercatox because it has some coin in open access that you want to sell, you can risk it. But there are better and safer exchanges than this one, believe it.

Well, that’s all for now, thank you for reading through this entire article.